NEWS

AmCham News tags

- Accounting / Financial

- AmCham Norway

- Company Profiles

- Education / Research

- Entertainment

- Food & Beverage

- Government

- Healthcare

- Hotel/ Restaurants/ Conferences

- Insurance

- International Leadership Interview Series

- Membership Guide

- Publications

- Rising Leaders

- Technology

- Trade

- Travel

Archive tags

Business News tags

- Accounting / Financial

- Airline / Travel

- Automobile / Transport

- Chemicals / Metals

- Communications/PR/Media

- Culture / Lifestyle

- Defense / Security

- Education / Research

- Energy

- Entertainment & Lifestyle

- Financial / Investment

- Food & Beverage

- Government

- Health

- Human Resources

- Insurance

- IP & Innovation

- Legal

- Management Consulting

- Manufacturing

- Pharmaceutical

- Politics

- Property / Real Estate

- Seafood

- Shipping & Offshore

- Statistics

- Tax

- Technology

- Trade

Mercer Global Pension Index: Norway Ranks #4

Category: Accounting / Financial

Norway’s income retirement system was ranked in the Melbourne Mercer Global Pension Index for the very first time this year. The index is widely perceived as the authority index on global pension systems, now measuring 30 countries and covering 60% of the world’s population.

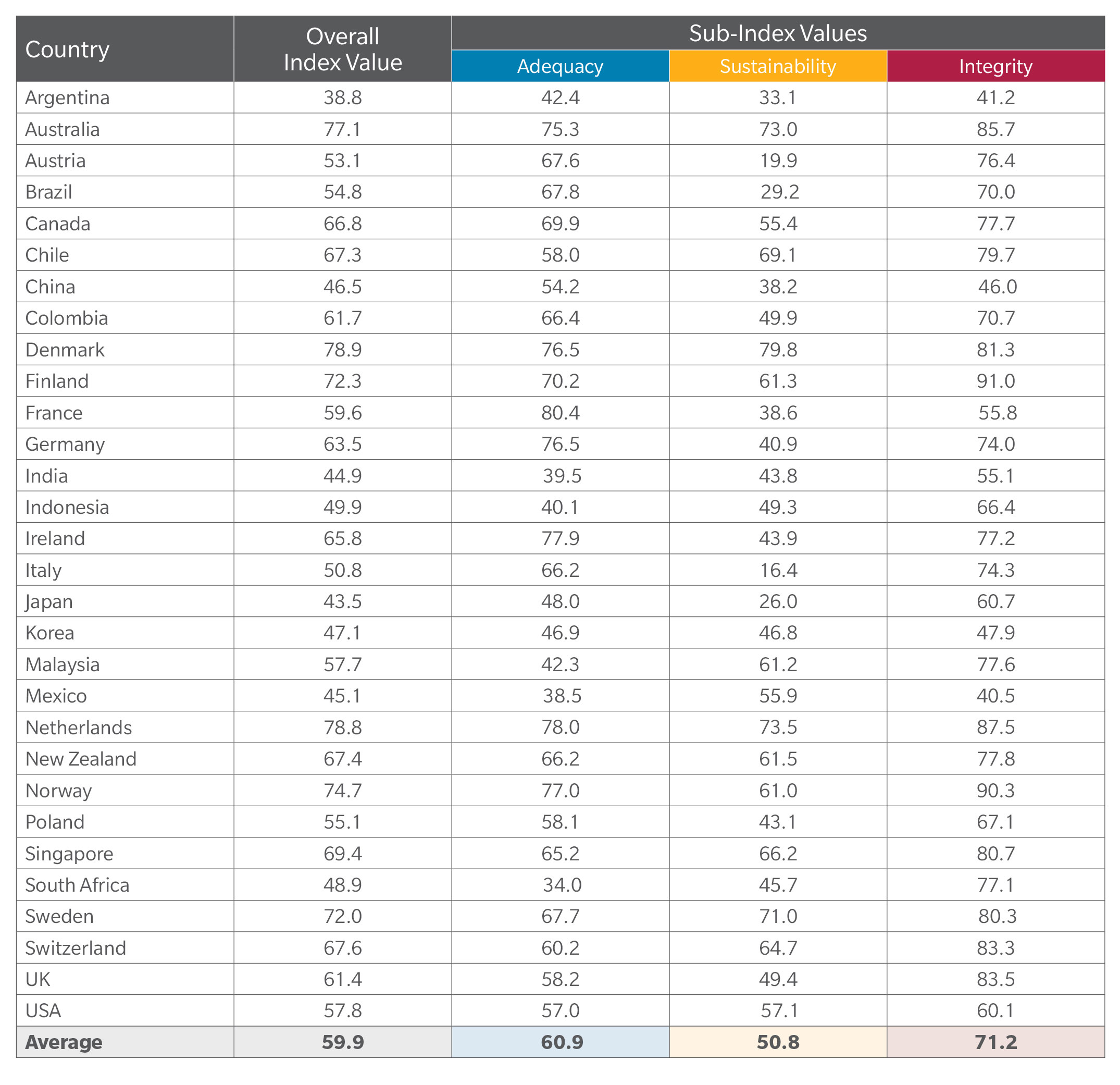

Although ranking a credible 4th place with an overall index value of 74.7 and noted as having a sound structure, with many good features, the system also has some areas for improvement.

“Particularly the sustainability part of the index shows that we have a long way to go in Norway”, says Per Myklestu, CEO of Mercer Norway. While Norway has a high score on integrity, rating 2nd place on this part, the Norwegian pension system obtains the 11’th place and a C+ rating on sustainability.

About the Melbourne Mercer Global Pension Index

Unsustainable pension systems in some countries need to learn from leading countries or risk creating intergenerational equity issues and disappointed retirees.

Now measuring 30 countries and covering 60% of the world’s population, this year’s ninth edition of the Melbourne Mercer Global Pension Index urges countries with unsustainable pension systems to take action now, rather than risk the need to take even more drastic action in the future.

Jacques Goulet, President of Health and Wealth at Mercer, stresses the need for countries to address sustainability when considering pension reform.

“Increasing life expectancies and low investment returns are having significant long-term impacts on the ability of many systems around the world to deliver adequate retirement benefits both now and into the future,” Mr Goulet says. “These pressures have alerted policy makers to the growing importance of intergenerational equity issues.”

Mr Goulet says Japan, Austria, Italy, and France are examples of developed economies whose pension systems don’t represent a sustainable model that will support current and future generations in their old age.

“This is due to a combination of factors including a lack of assets set aside for the future, low labour force participation at older ages, and significant demographic changes towards an ageing population,” says Mr Goulet. “If left unchanged, these systems will create societal pressures where pension benefits are not distributed equally between generations.”

Author of the report and Senior Partner at Mercer, Dr David Knox, says it’s not all doom and gloom; every country can be taking action now to move towards a better pension system.

“The primary objective of the Index is to benchmark each country’s retirement income system so we can learn to understand what best practice may look like, both now and into the future,” says Dr Knox. “From our research, it is clear which countries are leading the way in providing sustainable pension systems with adequate benefits and what others can learn from them to improve. Denmark, Netherlands, and Australia are three such countries which, whilst taking different approaches depending on their starting point, adopt a strong multi-pillar approach as highlighted in the Index.”

Professor Edward Buckingham at the Australian Centre for Financial Studies says that the report tells us that Australia’s pension system is good but there is room for improvement.

“Without the immigration of young people from other countries our ageing locally-born population would face significant challenges funding their retirement. The reason is simply that as we live longer, healthcare and public service costs will escalate and our society, like others, will face pressure to fund the needs of the old at the expense of the young. Optimising the use of savings set aside for retirement is a perennial responsibility that demands strategic improvement of pension systems worldwide,” says Professor Buckingham.

“Besides demographic constraints the various frameworks we create to guide investment decisions include moral and ethical dimensions that will shape the nature of wealth creation and transfer. This report contributes a uniquely global survey which provides a basis for articulating the merits and faults of many different approaches to these challenges.”

Supported by the Victorian Government and bringing together the best minds in Australia’s financial services and research expertise fields, the Index is testament to Victoria’s dominant position in the superannuation and financial services sectors.

Mr. Ken Ryan AM, Commissioner for Victoria to Europe says, “with a strong financial services sector and deep talent pool, Melbourne continues to lead the way in funds management, a central part of any superannuation and annuities system. The 2017 Global Financial Centres Index, released in September, ranked Melbourne in 13th place reflecting the progress the Victorian Government is making to ensure Victoria is recognised as a leading global financial centre.”

What does the future look like?

Some countries face a steeper path to system sustainability than others, and all start from a different origin with their own unique factors at play. Nevertheless, every country can take action and move towards a better system. In the long-term, there is no perfect pension system, but the principles of best practice are clear and nations should create policy and economic conditions that make the required changes possible.

With the desired outcome of creating better lives, this year’s Index provides a deeper and richer interpretation of the global pension systems. Having now expanded to include Colombia, New Zealand and Norway; the Index measures 30 systems against more than 40 indicators to gauge their adequacy, sustainability and integrity. This approach highlights an important purpose of the Index – to enable comparisons of different systems around the world with a range of design features operating within different contexts and cultures.

Melbourne Mercer Global Pension Index by the Numbers

This year’s Index reveals that Denmark, in its sixth year running, has retained the top position with an overall score of 78.9, ahead of the Netherlands and Australia at 78.8 and 77.1 respectively, with Norway on a 4th place with a credible overall index value of 74.7. Norway was noted as having a sound structure, with many good features, but also some areas for improvement.

A-Grades prove elusive in 2017 Index

In maintaining the integrity and relevance of the Index, two new questions have been included which has resulted in no country achieving the elusive ‘A’ grade. The first question addresses real economic growth in the sustainability sub-index, while the second question makes some allowance for voluntary pensions.

Naturally, the addition of a new question in the sustainability sub-index has resulted in the questions relating to assets and contribution levels having had their weightings reduced. Countries that have seen a significant improvement in their index value are those which have had high real economic growth during the last three years and where this is projected to continue during the next three years. These include China, India, Indonesia, Ireland and Malaysia. Conversely, countries with significant pension assets and high mandatory contributions but with lower real economic growth have seen a decline in their sustainability sub-index value. These include Canada, Denmark and the Netherlands.

“The Index is an important reference for policy makers around the world to learn from the most adequate and sustainable systems,” Dr Knox says. “We know there is no perfect system that can be applied universally, but there are many common features that can be shared for better outcomes.”

Melbourne Mercer Global Pension Index – Overall index value results

The following table shows the overall index value for each country, together with the index value for each of the three sub-indices: adequacy, sustainability, and integrity. Each index value represents a score between zero and 100.

Source: Mercer