AmCham Financial Forum: ESG Reporting Requirements & The Future of Search

Cross-industry member leaders gathered at Azets’ Skøyen office for a Financial Forum focusing on ESG reporting requirements in Norway and leveraging new AI technologies.

ESG reporting compliance: how best to find and use relevant data required in Norway

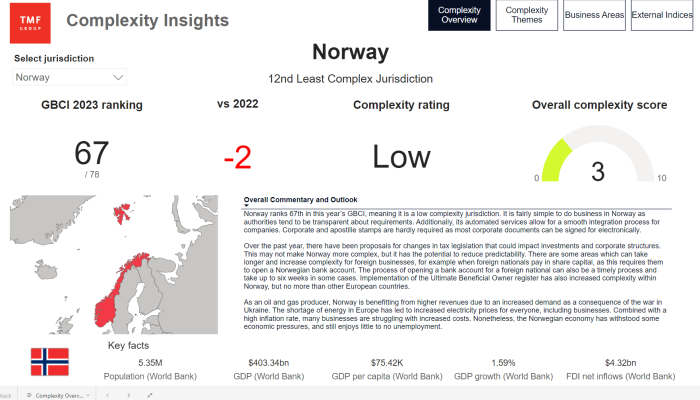

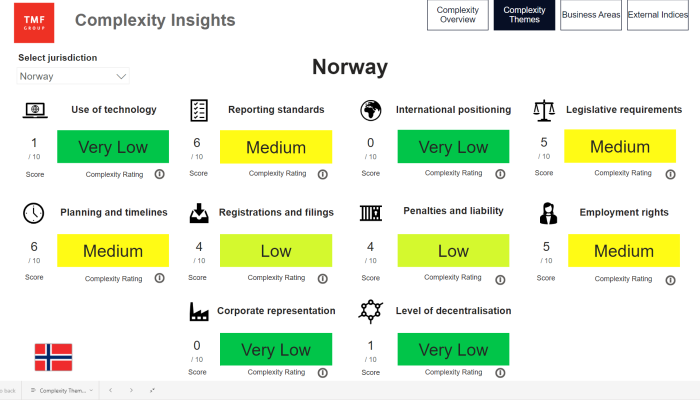

With Europe at the forefront of implementing legislation on sustainability, companies operating in Norway need to stay up to date on reporting requirements. In combination with increased expectations from customers, investors, banks and other stakeholders, this accelerates the need for companies to document their environmental impact.

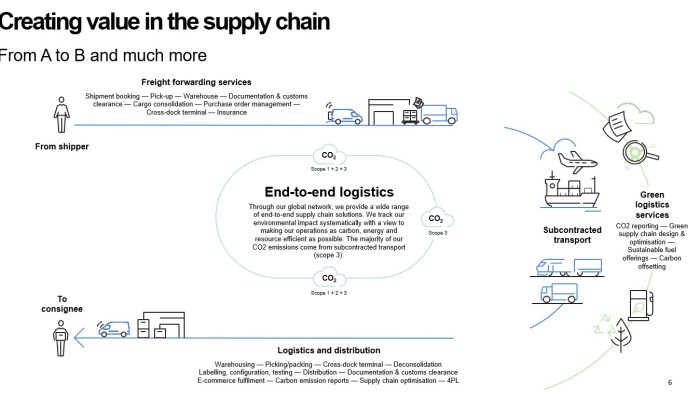

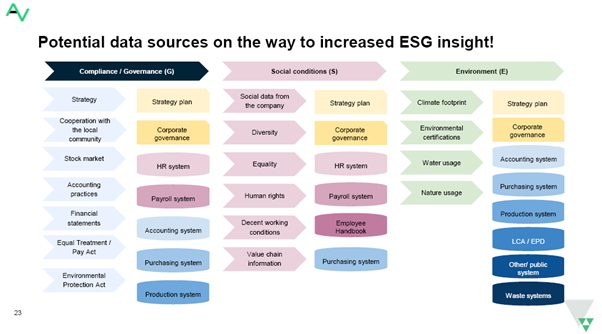

Azets provides holistic sustainability services for companies including ESG due diligence, strategy and sustainable business development and sustainability reporting. Mats Lorentsen, Head of ESG Services at Azets Advisory, gave participants an overview of the European Green Deal action plan, in particular the European Sustainability Reporting Standards (ESRS) framework’s data requirements and where to find data to increase ESG insight.

Lorentsen joined participants in examining the major opportunities and challenges facing financial roles. The demand for sustainability data is increasing quickly, as 75,000 companies in the EU are now facing this mandatory requirement. Companies with data that complies will have a competitive advantage as even stricter regulations are expected.

“Expectations are that the sustainability gap is increasing, but the capability is not growing as fast. We need to keep up!”

Presenters

The Future of Search and Leveraging AI

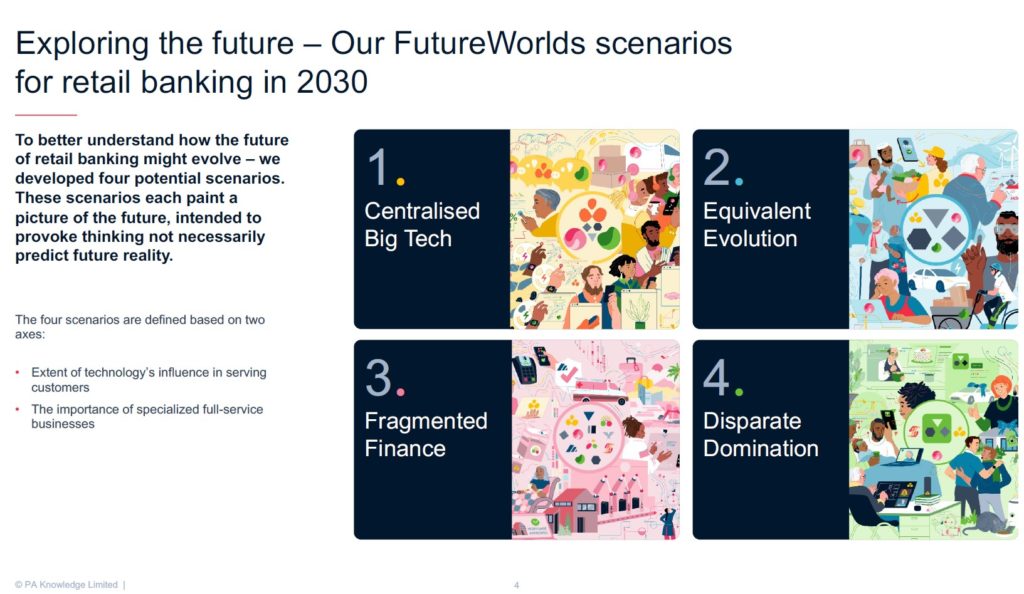

Google’s Industry Head of Finance and Insurance, Ida Haneborg, gave participants updates on Google’s search functions – with the most significant improvements in 20 years. By combining search with their Gemini (AI), search can give more comprehensive answers to longer and more complex questions. Not only does it provide more useful results, but it has also changed the ways in which you can search – by taking a picture or interacting with your environment through the user’s camera. With two billion users every day and 15% of searches being completely novel, Haneborg remarked that curiosity is outpacing technology! The group concluded by discussing use cases to leverage new AI functions including data collection for ESG.

About the AmCham Financial Forum

AmCham’s collaborative Financial Forum enables cross-industry leaders to openly exchange and learn from their peers – building a better understanding of what it takes to maintain successful international operations in Norway.

Please contact madeleine.brekke@amcham.no for interest in future meetings.

Previous Forums

AmCham Financial Forum: ESG Reporting Requirements & The Future of Search

AmCham Financial Forum: ESG Reporting Requirements & The Future of Search Cross-industry member leaders gathered at Azets’ Skøyen office for a Financial Forum focusing on ESG reporting requirements in

AmCham Financial Forum: Political Swings & Addressing Legacy Systems

Cross-industry member leaders gathered at DNB’s Bjørvika offices for a morning Financial Forum focusing on the upcoming US election and cloud enabled digital transformation in finance.

AmCham Financial Forum: AI in the Finance Function & Global Risk Updates

Cross-industry member leaders gathered at Marsh McLennan’s Skøyen offices for a morning Financial Forum focusing on top business risks for 2024 and modernizing financial teams.